32+ How much mortgage loan can i get

In general most lenders allow borrowers to take out 1000 50000. The interest rate is 26 and you and the amount can either be up to 90 of the propertys price or depending on the assessment whichever is lower.

Pin On Blogs

This includes your principal interest real estate taxes hazard insurance association dues or fees and principal mortgage insurance PMI.

. As part of an. Interest rates shown are for. The Maximum Mortgage Calculator is most useful if you.

Were not including any expenses in estimating the income you. However now youve qualified for a 15-year mortgage refinance with a fixed interest rate of 35. With a FHA loan yourdebt-to-income limitsare typically based on a.

Department of Agriculture USDA supports homeownership opportunities for low- and moderate-income Americans through several loan grant and loan guarantee. To be eligible the lender. For example if you make 50000 and have 20000 in.

The maximum amount you can borrow with an FHA-insured. The first step in buying a house is determining your budget. Its pretty simple your debt forgiveness is limited to how much you still owe.

The amount youre approved for however can depend on certain factors in your finances. You May Like. Rocket Mortgage lets you get to house hunting sooner.

Want to know exactly how much you can safely borrow from your mortgage lender. The following table shows the calculation methods for figuring out the highest payment you could qualify for based on credit rating. The total amount of your monthly.

My name is Salud Leon-Marroquin and I am proud to work with the community on behalf of New American Funding. If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit. Use this calculator to calculate how expensive of a home you can afford if you have 32k in annual.

Fill in the entry fields and click on the View Report button to see a. Medium Credit the lesser of. Can I Get A Reverse Mortgage On A Condo.

This increases the amount of taxes you owe for a given year either lowering your refund or bumping up your tax bill. As a highly-skilled Loan Consultant. For example if youre a Pell Grant recipient making less than 125000 and you have a balance of.

Over the next 20 years you could pay 116935 in interest. While there are no fixed limits on how much you can borrow a general rule of thumb is to borrow 2 to 3 times your gross income. How Much Mortgage Can I Afford With A Joint.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements. Are assessing your financial stability ahead of.

What Mortgage Can I Afford Based On Salary. Use this calculator to calculate how expensive of a home you can afford if you have 82k in annual. This mortgage calculator will show how much you can afford.

But ultimately its down to the individual lender to decide. How Much House Can I Afford With An Fha Loan. Saving a bigger deposit.

A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192.

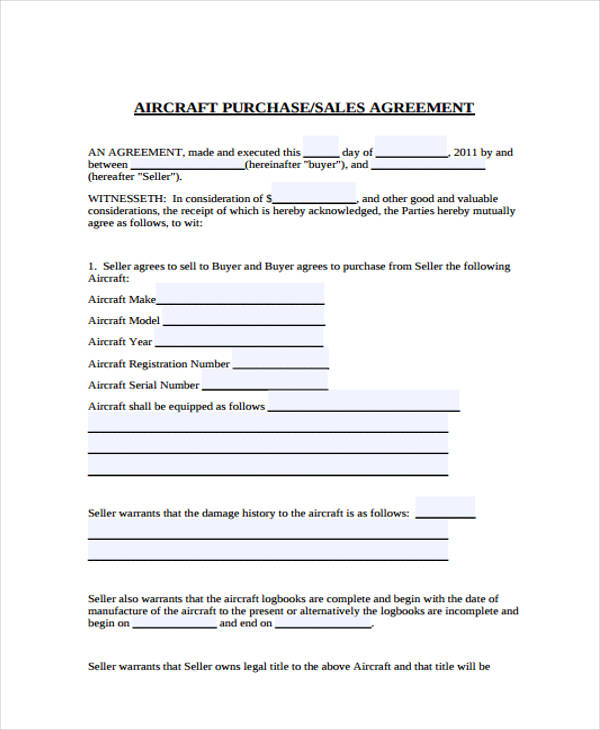

Free 32 Sales Agreement Forms In Pdf

Fred Saboori Home Mortgage Consultant Firestone Financial Group Linkedin

Three Main Needs Of The Employee Verification Letter You All Need To Know About Letter Of Employment Lettering How To Find Out

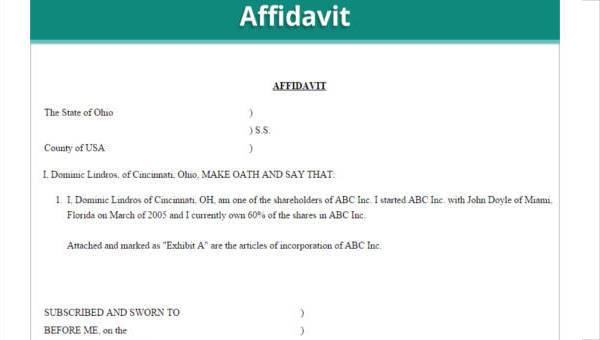

Free 32 Affidavit Forms In Ms Word

Mortgage Calculator Mortgage Loan Calculator Mortgage Amortization Calculator Mortgage Payment Calculator

Sample Notary Letter 32 Notarized Letter Templates Pdf Doc Free Premium Templates By Www T Free Word Document Free Resume Template Word Lettering

How To Pick A Mortgage Loan Term

Notarized Letter Templates 27 Free Sample Example Format Free Premium Templates Letter Template Word Printable Letter Templates Lettering

32 Happy Friday Quotes And Sayings In English With Images

Pin On Blogs

Pin On What Is The Best Essay Writing Company

Abdul Latif Seidu Associate Cloud Architect Go Cloud Careers Linkedin

How To Pick A Mortgage Loan Term

Three Main Needs Of The Employee Verification Letter You All Need To Know About Letter Of Employment Lettering How To Find Out

How To Pick A Mortgage Loan Term

2

Brian M Rice Nmls 262453 Home Facebook